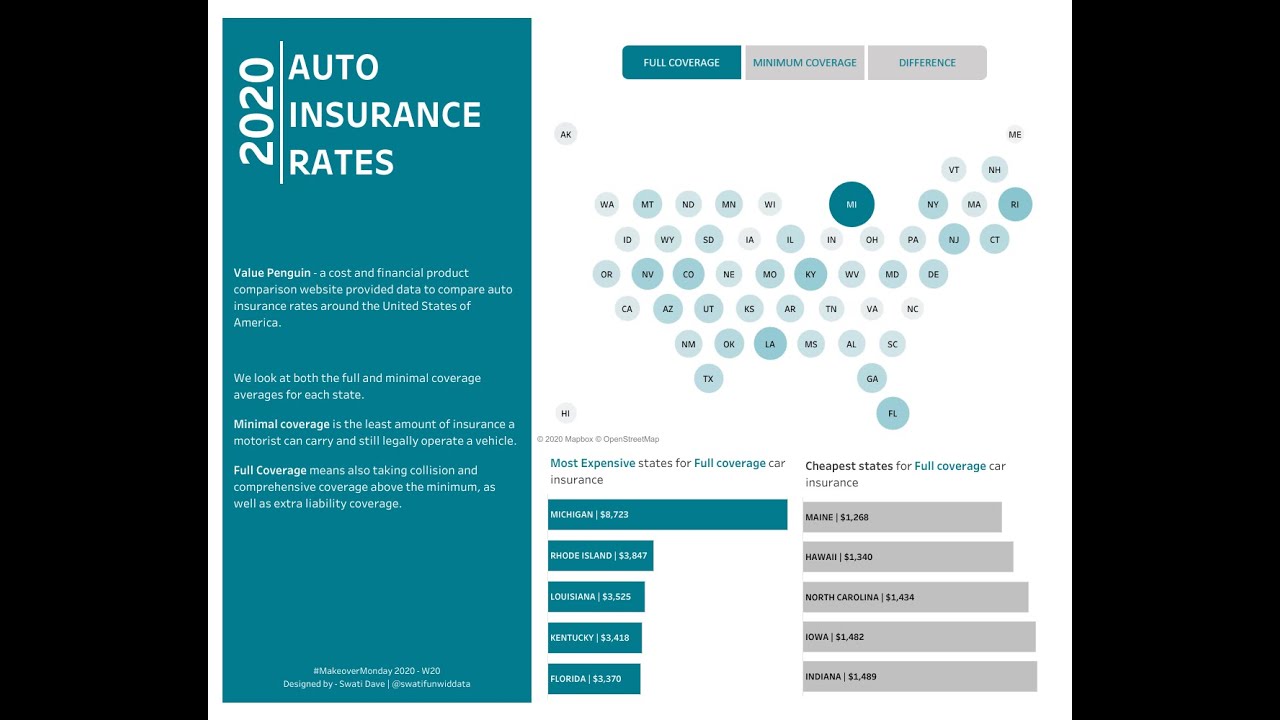

Auto Insurance is also a kind of insurance you can have between you and the company in the event of financial loss due to an accident or theft. If you possess any vehicle, it is quite mandatory to be covered by this kind of insurance policy since it focuses mainly on accidents that can happen while driving.

Since reviewing and comparing various Car Insurance quotes by different companies can be tiring and frustrating, agents were called to aid you in the choosing process. It is mainly a process of finding the perfect policy for you, your needs, wants, and current financial situation. Additionally, taking the time to compare these different auto insurance coverages can ensure you the cheapest possible auto insurance policy you can afford to maintain.

For you to further understand auto insurance, please pay attention to the basics of auto insurance, what they mean, and what they cover. It may also help to know about the current law on your place in regards to having auto insurance policies. It is because it is required by law in some areas to have a basic auto insurance policy first before one can be allowed to drive a vehicle legally. Basic Auto Insurance is commonly composed of these six coverages:

Bodily Injury Liability

This is the coverage that applies to injuries caused by the policyholder and family members while driving their vehicle. It can also be used for injuries caused by them while driving other people’s cars, with the latter’s permission. It aids well in covering the number of financial requirements that the medical bills of the injured will incur.

Medical Payments or Personal Injury Protection (PIP)

It covers the cost incurred by the injury of the drivers and also passengers using the policyholder’s vehicle. While medical payments cover the cost for such injuries, Personal Injury Protection also covers the cost from lost wages, and also the cost of replacing services by the one injured in an auto accident. If worst comes to worst, this coverage answers for the entire funeral cost.

Property Damage Liability

The third one, Property Damage Liability, covers for all the damages done by the policyholder’s car or by anyone driving their car with the former’s permission. It usually is for the damages for other vehicles, but it also covers the damages caused by every structure by the car, lamp posts, fire hydrant etc.

Click Hear: lip fillers before and after 1ml

Collision

This will be the payment for the repairs due to the damage the policyholder’s car sustained during an accident or a collision with another vehicle. It also includes impairments caused by potholes along the road. If it is proven that the policyholder is not at fault for the accident, his insurance company will try to recover the amounts paid, to the other driver’s insurance company. If the company succeeds, the policyholder will also be reimbursed for the deductible.

Comprehensive

Any other accidents or damages not caused by collision, like fire, falling debris, flood, earthquake, vandalism, getting stuck between a riot, having contact with birds, or even though seems far-fetched, missiles and explosion, the insurance company will reimburse you through this Comprehensive policy. This coverage is commonly sold with a separate deductible; however, some offer the glass portion of the coverage without one.

Uninsured or Underinsured Motorist Coverage

Another protection for the policyholder is the uninsured or underinsured motorist coverage. This coverage applies when an accident involves an uninsured or underinsured motorist, aside from the policyholder. It enables the policyholder to be entirely reimbursed for the damage done by an uninsured or underinsured motorist, especially when he’s the one at fault. It can also be applied even while the policyholder is a pedestrian, as long as there is an uninsured or underinsured motorist involved in the accident.

There are different kinds of insurance policies. Your trusted insurance company can elaborately explain it. Your insurance company will introduce you to an auto insurance company once they know that you own a car. If you do not have yet or you are still choosing an insurance company you like, exploring their website will aid you in narrowing the insurance company choices. The key in applying these policies is to make sure that you completely understand what was explained and what coverage a particular insurance policy, like auto insurance, has in it.

For more visit the article on this website.